What Is A MIC?

A Mortgage Investment Corporation (“MIC”) is an investment and lending company that allows investors to pool funds in a diversified and secured portfolio of residential and commercial mortgage loans. Shares of a MIC are qualified investments under the Canadian Income Tax Act (Section 130.1) for RRSP’s, RRIF’s, TFSA’s, LIRA’s, LIFF’s and RESP’s. The Income Tax Act requires that 100% of a MIC’s annual net income be distributed to its shareholders.

Specialize In

Investment

Growth

Savings

What types of investment vehicles is a MIC an Alternative for?

The key advantage here is diversification. Investing in a MIC allows an investor to indirectly invest in a pool of mortgages. This allows for a diversification level not feasible by an individual investor in a direct private mortgage investment. It allows an investor to reduce their risk as their investment is funding a pool of mortgages opposed to funding individual mortgages.

Mutual funds and stock market investments experience significant fluctuations in returns on investment based on market conditions and therefore bring significant level uncertainty and risk. In contrast, MIC investors realize relatively stable and consistent returns generally higher than most mutual funds. In addition, investors have added comfort knowing that the mortgages provided to borrowers are secured by Canadian real estate located major centers in British Columbia providing liquidity of the investments.

Financial institutions lock in term deposits and use these funds to invest in mortgages and other investments. MICs also invest in mortgages, however, charge higher interests to borrowers and therefore distribute higher returns to MIC investors than traditional Term deposits and GIC’s

Frequently Asked

Questions

- Mortgage Investment Corporations should have at least 20 shareholders. No shareholder can own more than 25% of the total outstanding shares.

- All MIC investments should be in Canada.

- 50% or more of the MIC investment assets should be in residential mortgage loans.

- Annual financial statements of all mortgage investment corporations must be audited.

- A MIC may invest up to 25% of its assets directly in real estate. However, they are not allowed to develop land or engage in construction.

- The Income Tax Act of Canada requires the distribution of 100% of a MICs annual net income (Income less expenses) and therefore MICs pay no corporate tax

- MICs are a flow-through vehicle for tax purposes.

Preferred Shares may be redeemed to an investor subject to the provisions of the Business Corporation Act (British Columbia) provided that the investor provides the MIC the required written notice of such desired redemption by registered mail or delivers notice to the registered office of the MIC. The MIC shall, within the redemption period referred to in the subscription agreement, then purchase the subject shares at the then book value plus any dividends declared but unpaid by the MIC for the relevant period prior to the date of redemption provided that the MIC shall not be required to redeem preferred shares of the MIC if such redemption would cause the MIC to cease being qualified as a mortgage investment corporation pursuant to the provisions of the Income Tax Act (Canada).

- Non-Registered personal and/or corporate account

- Individual RRSP account

- Spousal RRSP account

- TFSA account

- RESP account

Minimum initial investment is $25,000 CDN. Subsequent investments do not have a minimal requirement.

The MIC invests in 1st and 2nd mortgages in both the residential and commercial market. Majority of the mortgages are on residential single family homes in major center’s of British Columbia. Each mortgage investment is secured by a registered mortgage on title of the subject property.

Dividends are calculated and paid on a quarterly basis within 30 days of a quarter end. Investors can reinvest the dividends as additional shares into their investment or have their dividends paid out.

- Putting money in a MIC can be a secure way of growing your income or capital. With this vehicle, real assets are used to secure mortgages while other assets (i.e. insurance policies and personal guarantees) are used to provide additional protection.

- Access firsthand information and knowledge from industry experts with solid background in mortgage lending. Their extensive experiences with different investment scenarios allow them to make qualified decisions that help diversify and strengthen your mortgage investment portfolio.

- When placing your funds in a broad pool of mortgages you leverage the power of diversification, resulting in managed capital risk while maximizing your returns. With the goal of growing your money, the MIC efficiently manages each mortgage plan for higher returns.

- The MIC enjoys a preferential tax treatment under the Income Tax Act of Canada with cash inflows and capital gains being tax-free. This is beneficial to shareholders because it prevents double taxation especially when a company receives interest on income.

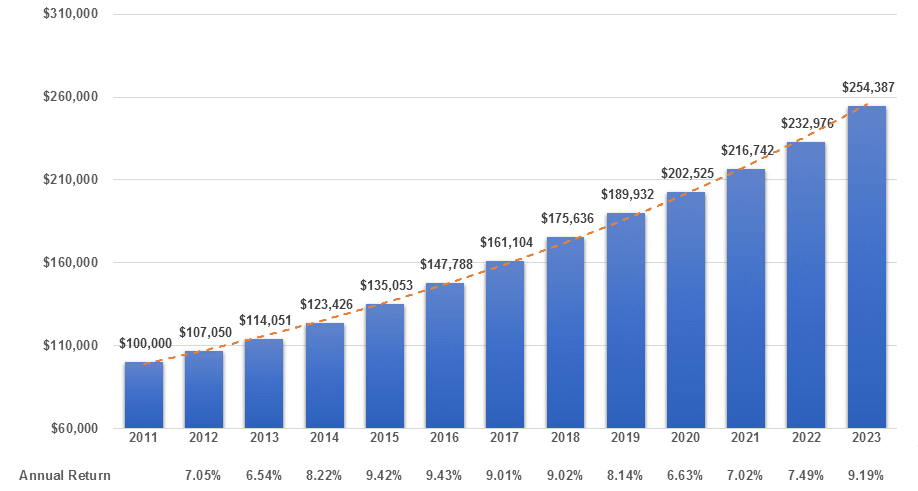

Metropointe MIC Results

Investment Growth of $100,000 Investment